52nd GST MEETING MINUTES 07.10.2023

Trade Facilitation measures

Amnesty scheme for appeal filing till 31st January 2024

> Who will it benefit?

Taxable persons

> who could not file an appeal against a demand order passed on or before 31st March 2023

> Whose appeal was rejected since it was not filed within the specified time limit

> How much amount to be pre- deposited?

> 12. 5% of the tax under dispute

> of which 2.5% has to be debited from electronic cash ledger

2.Taxability of Guarantees given to the banks against the credit limits / loans sanctioned by the Company

> Where the guarantee is provided by the directors :The value of the transaction to be treated as zero if there is no consideration paid by the company.

> Where corporate guarantee is provided for related persons including holding company to its subsidiary company :The taxable value of the transaction shall be 1% of such guarantee or the actual consideration whichever is higher (Sub-rule (2) in Rule 28 to be inserted for the purpose).

3.Restoration of provisional attachment of property

Proposed amendment to provide that the order passed in Form GSTR DRC -22 shall not be valid for more than one year from the date of order.

Note :No specific written order required

4. Clarification on issues related to Place of Supply

Circulars to be issued to clarify the place of supply related to i) transportation of goods, including by mail or courier, in cases where the location of supplier or the location of recipient of services is outside India; (ii) advertising services and (iii) co-location services.

5. Clarification related to export of services

> To be treated as export of services , the consideration for supply of services to be received in convertible foreign exchange or in Indian rupees wherever permitted by RBI

> Circular to be issued to clarify the admissibility of export remittances received in Special INR Vostro account, as permitted by RBI

Note : Rupee vostro accounts keeps a foreign entities holding in an Indian Bank in India Rupees and facilitate settlement of transactions in INR.

6. Supplies to Sez unit / sez development on payment of IGST and claiming of refund

Except commodities mentioned in Notification 1/ 2023 dated 31st July 2023, suppliers to Sez units / Sez developers can go for the IGST payment and refund route w.e.f 1st October 2023

Other measures pertaining to law and procedure

> Alignment of provisions of the CGST Act, 2017 with the provisions of the Tribunal Reforms Act, 2021 in respect of Appointment of President and Member of the proposed GST Appellate Tribunals – The eligibility and age criteria has now been specified.

> Amendment to Act and rules to give effect to ISD procedure

> ISD distribution procedure was made mandatory for distribution of Input Services procured by HO.

> In relation to the same amendments has been recommended in Section 2(61) , Section 20 of the CGST Act and Rule 39 of the CGST Rules.

Rate Changes

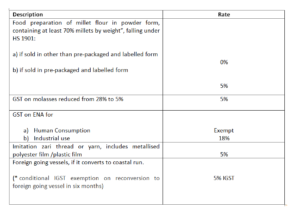

1. Changes in rate of Good

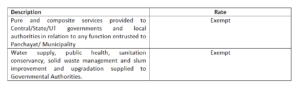

2. Changes in rate of Services

English

English