Compliances to Be Made in Respect of Foreign Remittances

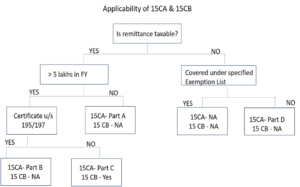

The Income Tax Lawrequires authentication of foreign remittances (payments) made to a Non-Resident or Foreign Company, for any amount which is taxable as per the existing laws. For this purpose, certain rules and guidelines have been framed by the Income Tax Act.

> As per Section 195, every person making a payment to Non-Residents (not being a Company), or to a Foreign Company shall deduct TDS if such sum is chargeable to Income Tax and the details are required to be furnished in Form 15CA.

> A person responsible for making such remittance (payment) has to submit the form 15CA, before remitting the payment. This form can be submitted both online and offline mode. In certain cases, a Certificate from Chartered Accountant in form 15CB is required before uploading the form 15CA online.

Form 15CB is the Tax Determination Certificate where a Chartered Accountant determines the taxability of the remittance as per Income tax Act along with the provisions of Double Tax Avoidance Agreement with the Recipient’s Residence Country. If the remittance is taxable, then the same shall be remitted only after deduction of withholding tax (ie, TDS).

The information provided in Form 15CB mainly includes the details of the remitter, details of the remittee, nature of remittance (whether salary, commission, royalty etc) as per agreement between the two parties, Bank details of the remitter and Tax Residency Certificate from the remitter if DTAA (Double Taxation Avoidance Agreement) if applicable.

Banks require these certificates before they make any remittance outside India.

Following documents are required for filing Form No. 15CA:

> Invoice

> Tax residency certificate (TRC)

> Form No. 10F

> Certificate that proves the Remittee does not have any permanent establishment within India.

Purpose of Form 10F

Form 10F is essentially a self-declaration that non-resident taxpayers are required to submit alongside their Tax Residency Certificate. This document holds paramount importance as it enables non-residents to avoid Tax Deducted at Source (TDS) on income earned from India.

Under the provisions of the Income Tax Act, non-resident individuals or entities can only avail of tax treaty benefits if they possess a valid tax residency certificate from their home country. If this certificate lacks crucial information, non-residents are compelled to submit a manual Form 10F, which can be a cumbersome process.

The CBDT had in July 2022 made electronic filing of Form10F mandatory.

To overcome the challenge of obtaining a PAN in India just for filing Form 10F, the CBDT came up with certain relaxations, wherein an exemption was provided to non-residents not having a PAN and not needing to obtain a PAN in India to continue furnishing Form 10F in self-certified manual format till 30 September 2023.

Recently, on the expiry of the exemption period, the Income-tax department has now enabled a new category while registering on the income tax portal, i.e., ‘non-residents not having a PAN and not required to have a PAN‘.

The elimination of the PAN requirement for Form 10F filing is a positive step towards making tax matters more accessible for NRIs.This change represents a significant stride in the direction of simplifying tax matters for non-resident Indians, making it easier for them to manage their financial affairs in the country.

Further clarification from the authorities regarding tax return obligations and digital signatures are awaited.

VBV Associates, Tax Consultants in Ernakulam offers outstanding services including Audit & Assurance, Tax Consulting, Accounting, and Corporate Law Advisory services. Connect with us to know more in detail.

English

English